7.3 - Mindset 3

Question 1- rate the urgencies.

Schedule possible tariffs and rates. 7.2 has produced the best offset result it could through passthroughs, substitutions and tariff sharing. Are there now scenarios which create losses? Cash shortfalls? If yes, implement:

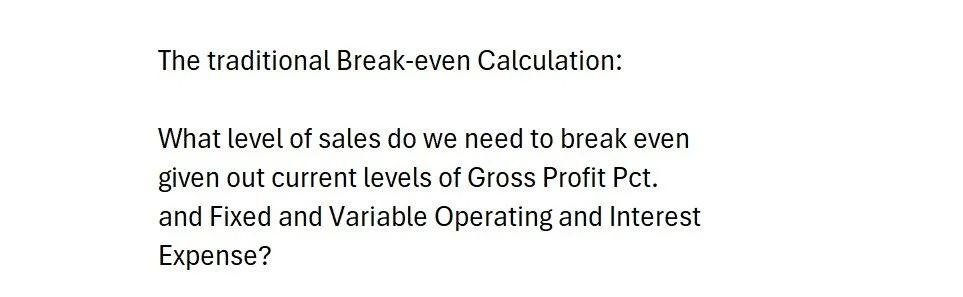

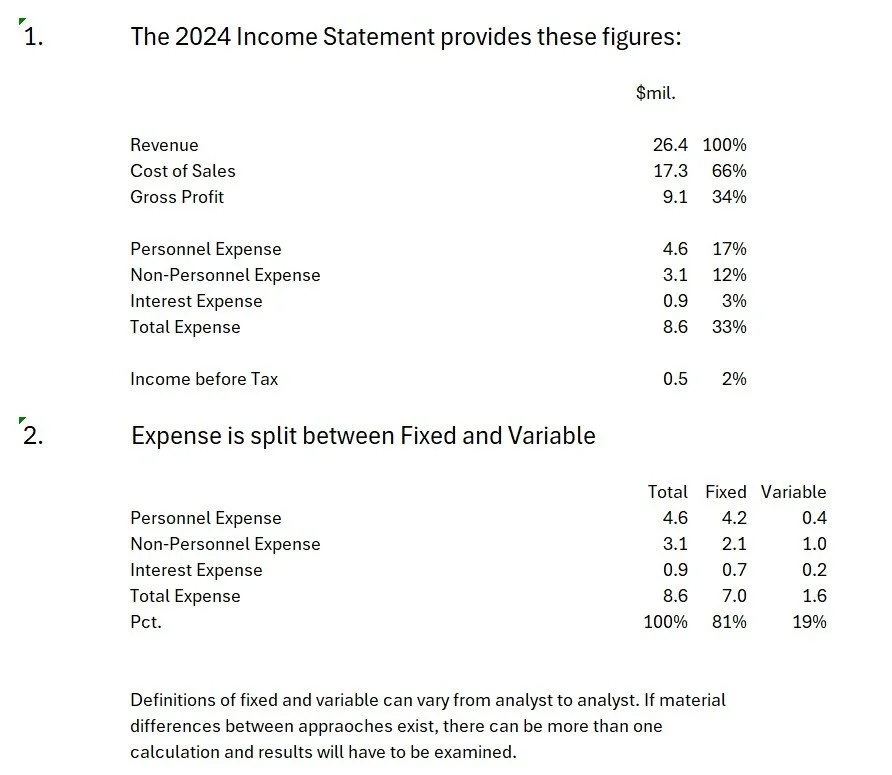

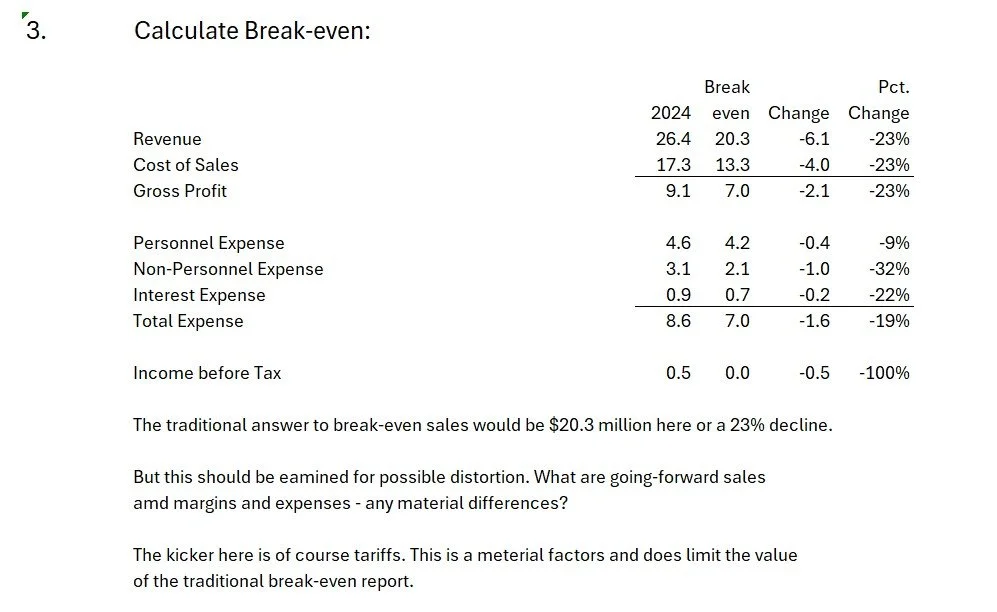

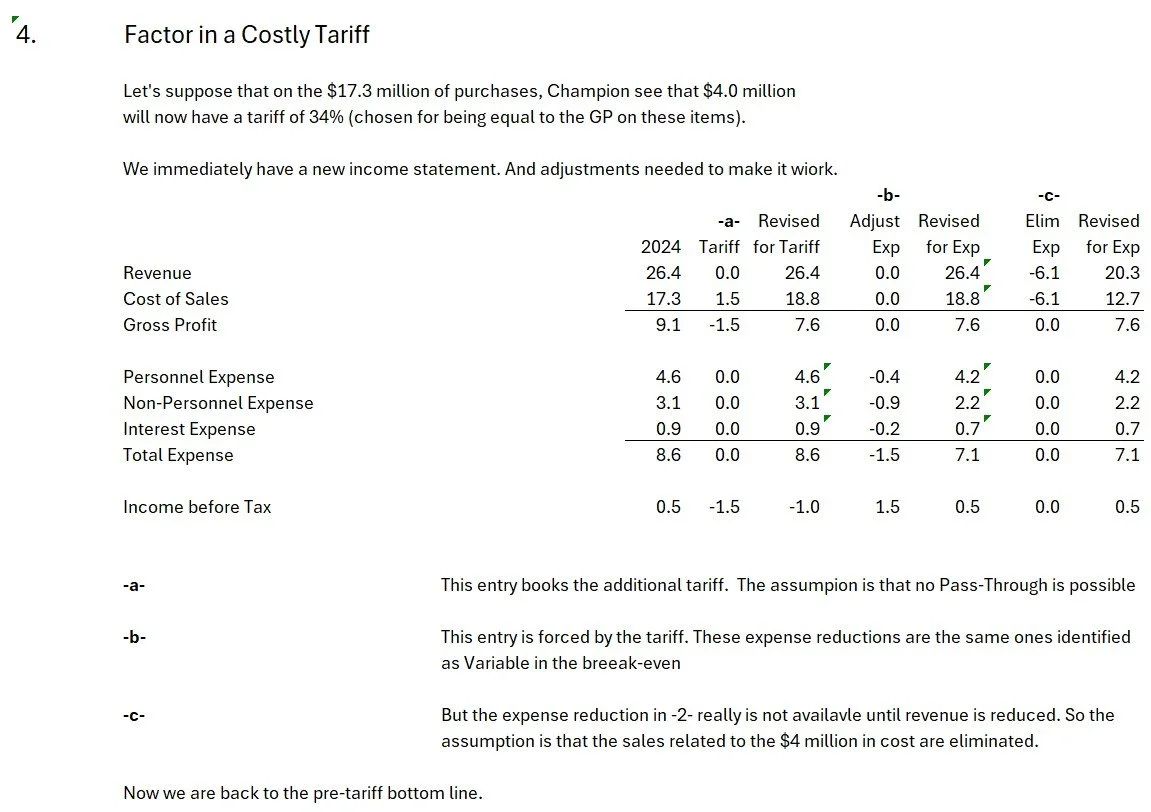

For income, make a breakeven analysis and list of moves to offset as much as possible with forecast for periods ahead.

For cash, make a cash reserve assessment and list of moves to offset as much as possible with forecast for periods ahead. Include relevant income items from income task.

The cash task picks up in 7.4.

Question 2 - the income task

With tariff-related moves exhausted, the task of managing profit and/or avoiding losses is now up to the non-tariff world of profit improvement tactics.

In that regard, BirdTraffic’s Conventional Wisdom Actions outlines what are generally considered to be the options.

Using the Conventional Wisdom Income Changes

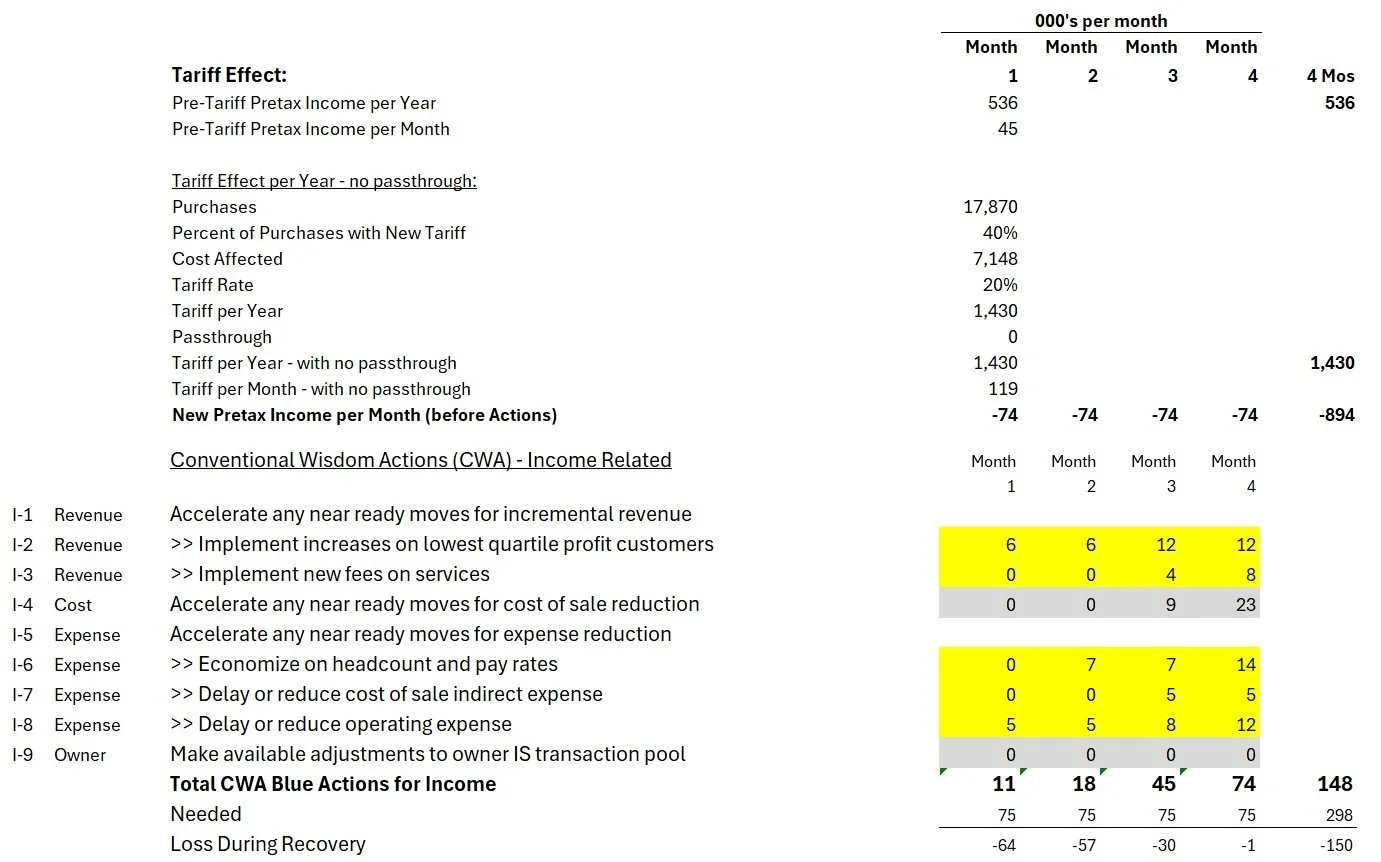

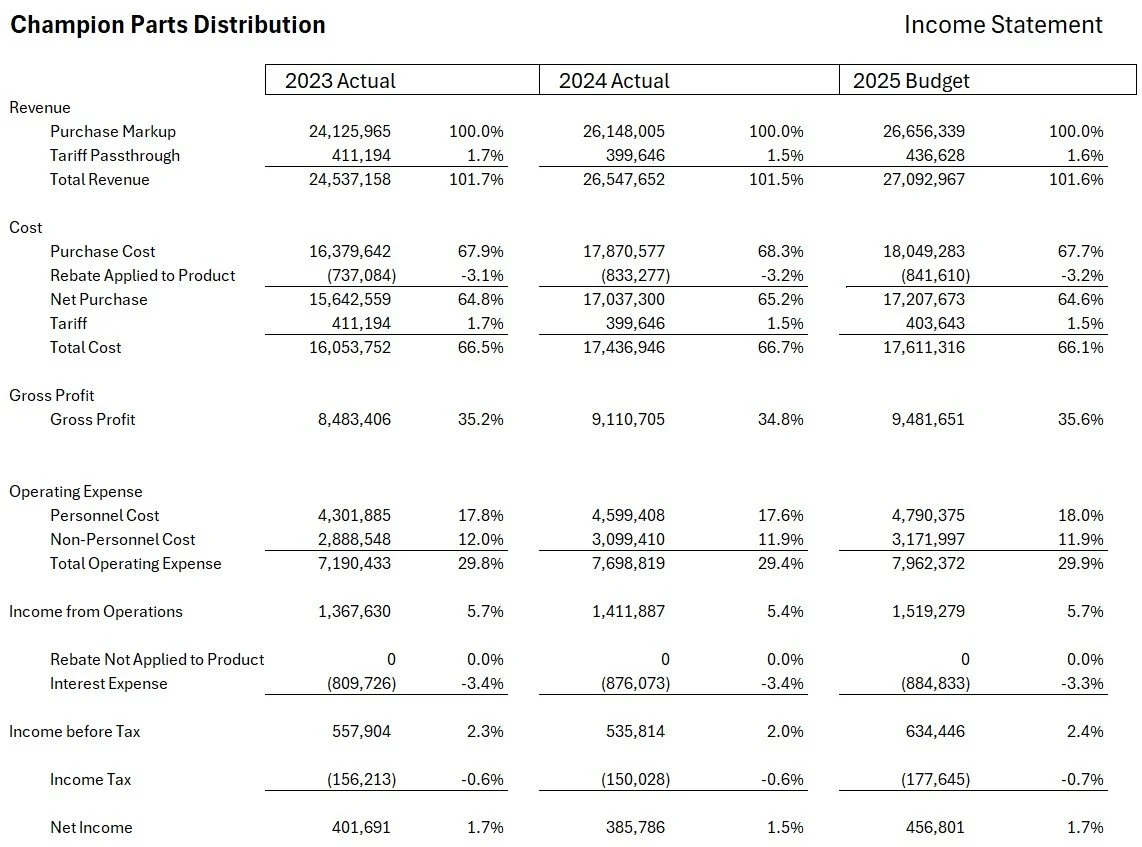

Champion has pre-tax income of $535K on sales of $26.5 mil. Purchases are $17.9 mil.

A 12% tariff on 25% of its purchases, with no passthrough, wipes out this pretax income.

Worse, Champion believes that tariffs could be 20% on 40% of its purchases, or $1.4 mil.

With no pass-through, this would force a loss of $894K. The company is hopeful that some passthrough plans will be understood. However, it wants to assess its situation if that is not true. Champion sets up a planning scenario using CWA Blue with a goal of restoring annual income to $894K by the 4th month.

Taking CWC Actions to Counter Tariff

Champion gets to a breakeven in four months if these actions are successful. Loss during this time is $150k.

All of which is another way of emphasizing the importance of passthroughs - where Mindset 2 can help with negotiating.

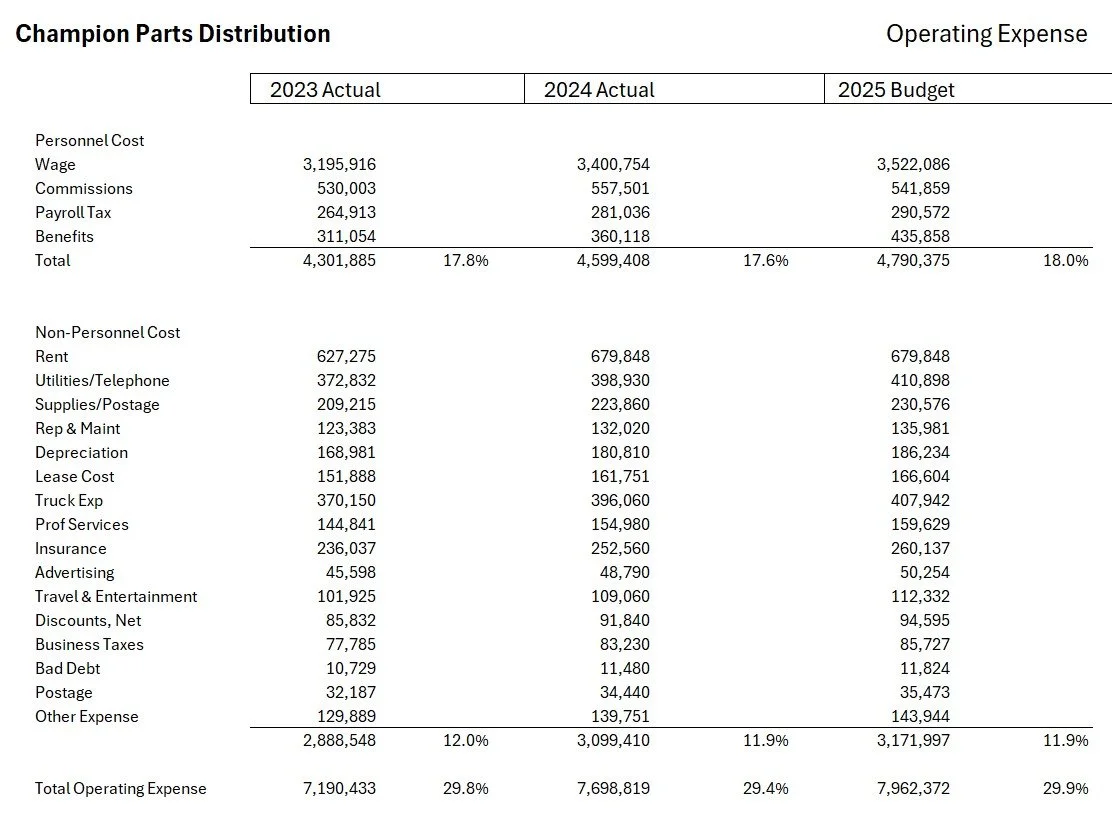

Financial Statement Reference